The financial USA represents the intricate and powerful economic structure of the United States, a system that continually evolves and influences global markets. This extensive network includes banking institutions, stock exchanges, investment firms, and a robust regulatory framework designed to ensure stability and growth. Understanding the financial USA involves exploring its key drivers, recent trends, and the impact of technological advancements on its future. From individual savings to vast corporate investments, the financial USA touches every aspect of economic life, offering both challenges and unparalleled opportunities. Its resilience and innovation make it a focal point for global economic analysis and investment strategies, consistently setting benchmarks in the international financial arena. We dive into how the financial USA operates, who the major players are, and what the future holds for this economic powerhouse.

Navigating the Financial USA Your Essential Guide to America's Economy

The financial USA refers to the robust and dynamic economic landscape of the United States, encompassing its vast banking sector, capital markets, regulatory frameworks, and diverse financial instruments. It plays a pivotal role globally, influencing international trade and investment, driven by continuous innovation and a commitment to market stability. Understanding the financial USA is crucial for anyone seeking to navigate its opportunities and challenges effectively, impacting individuals, businesses, and governments alike. Let's explore this powerhouse together.

Understanding the Core of Financial USA

America's financial system is incredibly vast and complex. It's a key driver of the entire US economy, supporting everything from local businesses to massive international corporations. This system allows capital to flow efficiently, encouraging innovation and economic growth across all sectors. You might wonder how it all works.

Key institutions like banks, credit unions, and investment firms form the bedrock of the financial USA. These entities manage savings, facilitate loans, and enable investments. They provide essential services that keep money moving and accessible for everyone. Your daily financial interactions directly connect you to this expansive system.

The stock and bond markets are crucial components within the financial USA. They provide platforms where companies can raise capital and investors can buy and sell securities. These markets reflect economic sentiment and future expectations, acting as vital indicators of financial health. It's a marketplace where dreams and ideas find funding.

Government policies and central bank actions also greatly influence the financial USA. The Federal Reserve, for instance, sets interest rates and manages the money supply. These actions impact borrowing costs, inflation, and overall economic stability. Their decisions truly ripple throughout the entire system.

Key Players Shaping the Financial USA Landscape

Many institutions and individuals contribute to the vitality of the financial USA. Understanding who they are helps you grasp the bigger picture. From the largest banks to individual investors, each plays a part in this dynamic environment. This interaction fuels America's economic engine.

Consider the role of commercial banks, which serve millions of Americans daily. They offer checking accounts, savings options, and various loan products. Investment banks assist companies with mergers, acquisitions, and raising capital through securities offerings. These services are fundamental to business operations.

Regulatory bodies also maintain order and fairness within the financial USA. Organizations like the Securities and Exchange Commission SEC and the Federal Reserve ensure compliance and protect consumers. Their oversight helps to prevent fraud and maintain market integrity. This framework builds trust in the system.

| Institution Type | Primary Role in Financial USA | Examples |

| Commercial Banks | Retail and business banking, loans | JP Morgan Chase, Bank of America |

| Investment Banks | Underwriting, M&A advisory | Goldman Sachs, Morgan Stanley |

| Regulatory Agencies | Oversight, consumer protection | Federal Reserve, SEC, FDIC |

| Stock Exchanges | Securities trading platforms | NYSE, NASDAQ |

| Insurance Companies | Risk management, financial protection | MetLife, Prudential |

What Others Are Asking About Financial USA

What is the current economic outlook for the financial USA in 2026?

The financial USA in 2026 projects continued adaptation to global economic shifts and domestic policy changes. Experts anticipate moderate growth, driven by technological advancements and evolving consumer spending patterns. Inflation management and labor market stability remain key concerns for policymakers. Opportunities will likely emerge in renewable energy and digital infrastructure sectors, making the financial USA an interesting place to watch.

How do interest rates affect the financial USA and its consumers?

Interest rates significantly impact the financial USA by influencing borrowing costs for consumers and businesses. Higher rates can slow economic activity by making loans more expensive, affecting mortgages, credit card debt, and corporate investments. Conversely, lower rates stimulate spending and investment, encouraging economic expansion. This delicate balance guides financial decisions for many in the financial USA.

What role does technology play in modernizing the financial USA?

Technology transforms the financial USA by driving innovation in areas like fintech, blockchain, and AI. Digital platforms offer enhanced accessibility and efficiency for banking, investing, and payments. These advancements streamline operations, reduce costs, and create new financial products and services, empowering consumers and businesses alike. The modernization of the financial USA continues at a rapid pace.

Where can individuals find reliable financial advice in the financial USA?

Individuals in the financial USA can find reliable financial advice from certified financial planners CFPs, registered investment advisors RIAs, and reputable non-profit credit counseling agencies. It's important to choose professionals with appropriate credentials and transparent fee structures. Many banks and online platforms also offer educational resources to guide personal finance decisions. Seeking informed guidance is a smart move for your financial USA journey.

Why is regulatory oversight important for the financial USA?

Regulatory oversight is vital for the financial USA to ensure market stability, protect investors, and maintain fair competition. Regulations prevent systemic risks, combat fraud, and enforce ethical practices within financial institutions. This framework builds public trust and fosters a secure environment for economic activity. Strong oversight keeps the financial USA functioning effectively and fairly for everyone.

FAQ About Financial USA

Who are the main regulatory bodies in financial USA?

The main regulatory bodies in the financial USA include the Federal Reserve, the Securities and Exchange Commission SEC, the Federal Deposit Insurance Corporation FDIC, and the Office of the Comptroller of the Currency OCC. These entities ensure stability and protect consumers. They oversee banks, securities markets, and financial institutions.

What makes the financial USA market so influential?

The financial USA market is influential due to its sheer size, depth, and innovation. It attracts global capital, sets international standards, and offers diverse investment opportunities. Its open and dynamic nature allows for rapid adaptation and growth. Many global financial trends originate here.

Why should I care about the financial USA's health?

You should care about the financial USA's health because it directly impacts your job prospects, investments, savings, and borrowing costs. A healthy financial system fosters economic growth and stability. When the financial USA thrives, opportunities generally expand for everyone.

How does one participate in the financial USA investment opportunities?

One participates in financial USA investment opportunities by opening brokerage accounts, investing in mutual funds or ETFs, or directly purchasing stocks and bonds. Consulting a financial advisor can help tailor strategies to individual goals. Start with a clear plan and understanding of risks.

Summary of Key Points About Financial USA

The financial USA is a complex, influential system that drives the American economy and impacts global markets. It comprises vital institutions like banks, investment firms, and robust regulatory bodies that ensure stability and consumer protection. Technology continues to modernize the financial USA, offering new opportunities for growth and efficiency. Understanding its mechanisms and trends empowers individuals and businesses to make informed decisions and capitalize on available prospects. The health of the financial USA is essential for everyone's economic well-being.

Dynamic US financial landscape, global economic influence, robust regulatory environment, technological innovation in finance, diverse investment opportunities, consumer finance trends in financial USA.

Top Trending Conferences In The USA You Shouldn T Miss In 2026 Finance Year 2026 Financial Growth Concept With Coin Stacks Stock Photo Image Year Financial Growth Concept Coin Stacks Wooden Cubes Numbers Stacked Coins Represent Economic Forecast 383599460 FY 2026 Budget Official Website Of Arlington County Virginia Government Balancing The Fy 2026 Budget Infographic Page 2

Dates For Fiscal Year 2026 Fiscal Year Calendar 2026 2026 Financial Growth Concept Stock Of Financial Growth Concept Shiny Metallic Numbers Stand Prominently Amidst Scattered Gold Silver Coins Numbers Have Smooth 386114768 Fiscal Calendars 2026 Free Printable Word Templates Fiscal Calendar 2026 OneSeven CEO Talks Growth Aspirations Teases 1 5bn Deal OneSeven USAToday BFAF 2025 Logo Basic

CFO S Roadmap Strategic Financial Planning For 2026 And Beyond MYND A Cfo S Guide To Strategic Financial Planning For 2026 US National Debt Could Surge To 40 Trillion By 2026 Raising Concerns 1200x675 Cmsv2 A494ac93 2f8c 516c B9faTop 10 Finance Trends 2026 Automation AI Beyond Blog Banner 04 12 25 Ministry Of Finance Publishes Its Draft Budget For 2026 3101e35a Cbea 0bd1 2df8

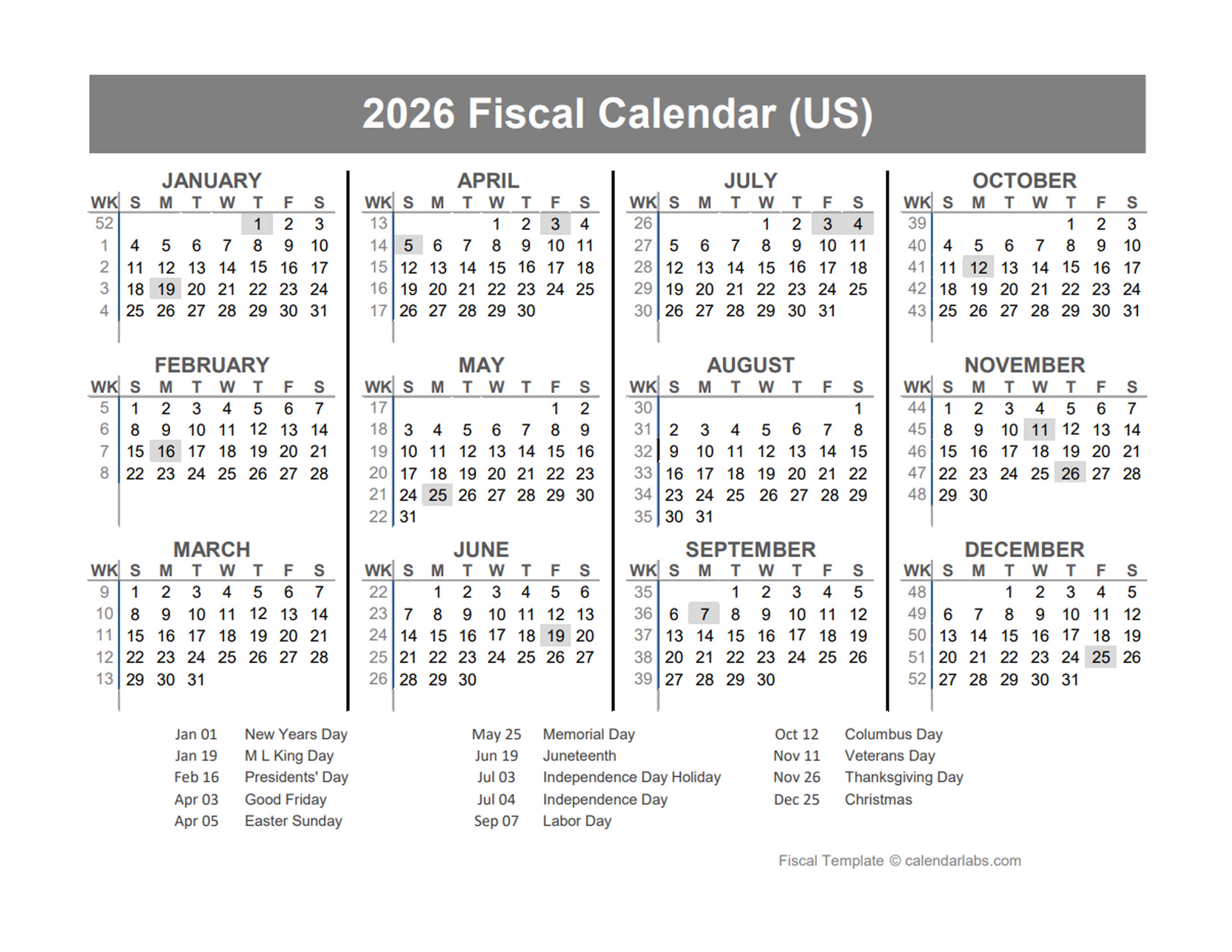

2026 Fiscal Calendar With Week Numbers Free Printable Calendar Fiscal Calendars 2026 Free Printable Word Templates 1024x777 2026 Fiscal Calendar USA Free Printable Templates 2026 Fiscal Year Calendar Jan Us 01 2026 Fiscal Year Calendar Templates 2026 Fiscal Year Calendar Jan Us 09 2026 Financial Growth Path To Prosperity Stock Financial Growth Path To Prosperity Shiny Metallic Numerals Stand Prominently Amid Stacks Coins Arranged Reflective 386114750

2 Thousand 2026 Finance Royalty Free Images Stock Photos Pictures Development Success Motivation 2026growth Chart 260nw 2556667999 Premium Photo The 2026 Year For Business Concept 3d Rendering 2026 Year Business Concept 3d Rendering 35719 15685 2026 Conference Save The Date Png Mission Investors Exchange 2026 Conference Save The Date 2026 Federal Government Pay Raise One Page Calendar 2026 With Usa Holidays Sunday Start Landscape En Us 712x550

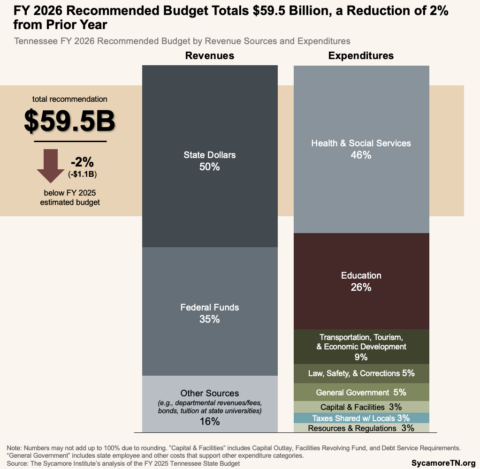

The Coming 2026 Economic And Financial Crisis Part 2 Of 8 YouTube Unlocking The 2026 Primary Schedule What You Need To Know Image 1 The Budget In Brief Summary Of Gov Lee S FY 2026 Recommended Budget Fy 2026 Recommended Budget Totals 59.5 Billion A Reduction Of 2 From Prior Year 480x469 2026 Federal Calendar Printable Calendar 2026 Calendar Usa Bimcal 11

2026 USA Fiscal Quarter Calendar Free Printable Templates 2026 Fiscal Year Calendar Jan Us 10 What S New For Your Money In The 2026 Financial Year Lightbulb Wealth 2026fy US Small And Mid Sized Businesses Expect Stronger 2026 BofA Survey Analyzing Financial Projections For 2026 With Magnifying Glass Stock 1000 F 1399148174

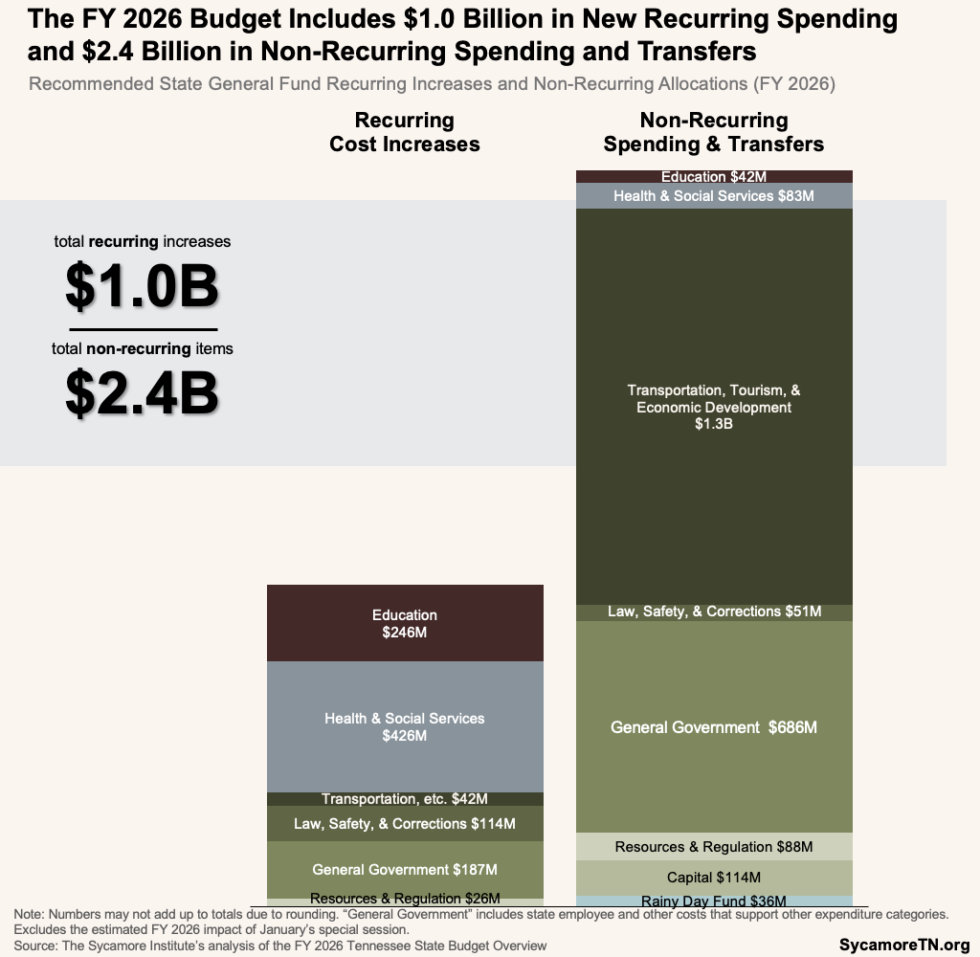

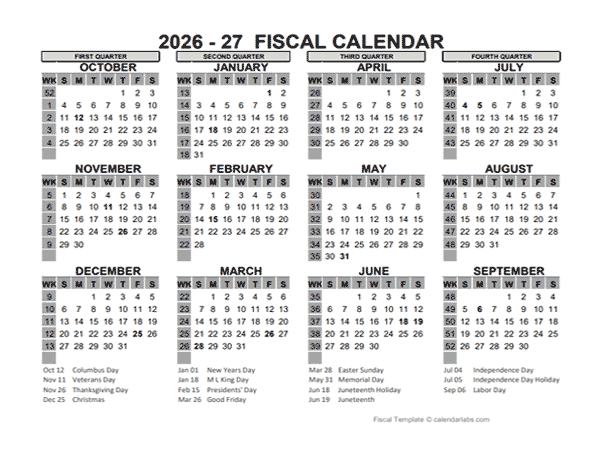

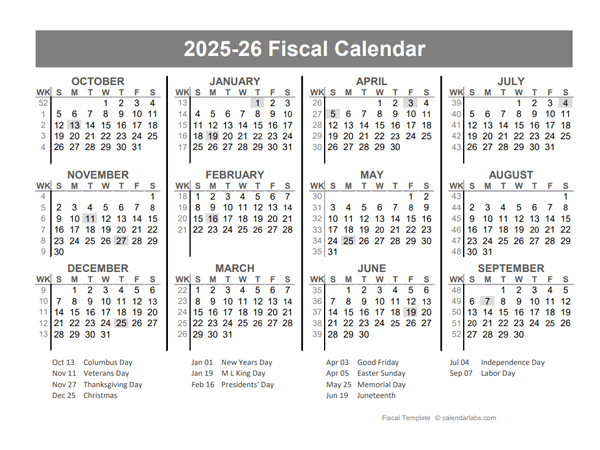

2025 2026 Fiscal Calendar Slide 2026 Calendar The Budget In Brief Summary Of Gov Lee S FY 2026 Recommended Budget The Fy 2026 Budget Includes 1.0 Billion In New Recurring Spending And 2.4 Billion In Non Recurring Spending And Transfers 980x957 2026 Financial Budget Planning And Management Concept Wooden Blocks Financial Budget Planning Management Concept Wooden Blocks Displaying Year Icons Symbolizing Saving Money Investment 355098117 2026 US Fiscal Year Template Free Printable Templates 2026 27 Fiscal Year Calendar Oct Us 06

2025 2026 Fiscal Year Quarters Template Free Printable Templates 2025 26 Fiscal Year Calendar Oct Us 10 2026 Capital Gains Rates 2026 Year Business Concept 3d Rendering 35719 17355 Fact Sheet The 2026 Executive Budget S Fiscal Outlook Fiscal Policy 2025.01.29 Fiscal Fact Sheet IMAGE 6 U S GDP Growth Key Trends And Future Outlook 2017 2026 1. US Growth2017 2026 990x990